Accounting challenges with New Markets Tax Credits

While New Markets Tax Credits (NMTCs) have been around since 2000, the program has found renewed popularity over the past few years. Institutions are making these investments for tax considerations, but there are accounting impacts for institutions investing in projects supported by NMTCs that are not as widely understood as they need to be.

The NMTC program was created to encourage investment in low-income communities by providing tax credits to investors equal to 39% of the investment. To receive these credits, a qualified Community Development Entity (CDE) applies to the Community Development Financial Institutions Fund. If approved, this domestic corporation or partnership will obtain investments from taxpayers and often loans from a financial institution. The CDE must use these funds to make investments in one or more qualified, active, low-income businesses located in low-income communities.

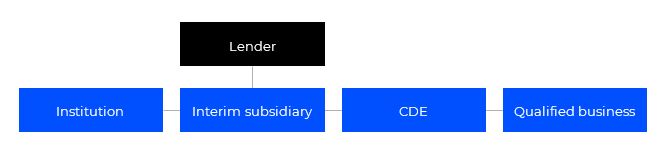

The entity structure can vary, but a typical structure to use NMTCs is as follows:

In this example, the investing institution owns 100% of the interim subsidiary, and the interim subsidiary uses the investment from the institution along with a loan from a lender to invest in the CDE. NMTCs flow back to the taxpayer, which is the institution.

Return on investment

Another important fact in most of these arrangements is that the CDE will usually receive enough return on investment to repay the lender but not enough to repay the investment from the institution. Thus, the institution’s return on investment is limited to the NMTCs and the tax benefits of losses generated by the qualified business.

Let's say the institution invests $2.5 million in an interim subsidiary. The subsidiary obtains a $7.5 million loan from a lender and invests the full $10 million into the CDE (which invests in the qualified business).

The qualified business and CDE return enough funds to the subsidiary to repay principal and interest due on the loan. The institution receives $3.9 million in NMTCs (39% of $10 million) over the next seven years and taxable losses that are passed through to the institution for 15 years (the life of the project). The institution’s investment should have no remaining value at the conclusion of the project.

Accounting considerations

An institution must address several accounting considerations when making an investment in a CDE.

First, it must determine how to account for its direct or indirect investment in each entity. If the institution has a variable interest in an entity and is the primary beneficiary of that entity, the institution will need to consolidate that entity in its own financial statements. Consolidation accounting is also required when the institution has a controlling financial interest in another entity.

If consolidation accounting is not necessary, the institution will account for the investment under the equity method if it has significant influence. Since these entities are often structured as partnerships, LLCs or similar entity types, significant influence is presumed if the investment is 3-5% of total equity, though careful analysis is required regardless of the size of the investment.

If the institution does not exercise significant influence, the institution will measure the investment either at fair value or using the alternative measurement method (cost plus/minus observable changes in market value).

If the equity method or the alternative measurement method are used, the institution must also recognize impairment of the investment when appropriate. As mentioned, impairment losses will occur because the institution typically doesn’t receive its investment back. These losses are generally recognized over the life of the investment when the recorded investment exceeds the expected benefit of future NMTCs.

In addition to accounting for the investment, the institution must consider the impact of pass-through losses from the CDE and the NMTCs when calculating current and deferred taxes.

Accounting challenges and possible rule change

Unfortunately, the accounting for these projects does not match up on the income statement as one might expect. For example, impairments recognized for the investment are not usually recognized in the same periods or in the same proportion as the benefits received from the investment (primarily the NMTCs). Additionally, the investment losses are recognized in noninterest income (or expense), while the tax benefits of the investment are recognized in income tax expense (benefit).

An optional method, called the proportional amortization method, is available for investments in affordable housing projects, but currently this method cannot be applied to different tax credit programs like NMTCs. The proportional amortization method allows an entity to match the investment losses in the same accounting periods as, and in proportion to, the tax benefits received. It also allows the entity to net investment losses with the tax benefits and present them as part of income tax expense.

The Financial Accounting Standards Board (FASB) has proposed expanding the election to use the proportional amortization method to other types of tax credits meeting certain criteria. The FASB is likely to finalize this standard, which would allow institutions to use the proportional amortization method for NMTCs in most cases.

How Wipfli can help

If your institution is considering an investment in a community development project supported by NMTCs, Wipfli advisors can help you better understand the related accounting issues and status of the FASB’s proposed standard. The complexities of NMTCs require a deep understanding of the issues and changing standards. Contact us to learn how your institution can benefit.

Sign up to receive additional financial services information in your inbox, or continue reading on: