Wipfli CECL poll results: How do you compare to your peers?

In early November, Wipfli hosted an audit and accounting webinar for financial institution clients. (If you weren’t able to attend, click here to watch the recording.) Not surprisingly, a key focus of the webinar was CECL, since nonpublic institutions continue to prepare for adoption in 2023.

As part of the webinar, we conducted polling questions to find out more about where our clients are in the implementation process and their expectations for key implementation decisions. The results provided valuable insight, so we wanted to share them here, along with our commentary.

Each of the polling questions was answered by approximately 180 respondents. The majoriy of the participants were personnel from community banks and credit unions. Our poll did not have significant representation from SEC registrants.

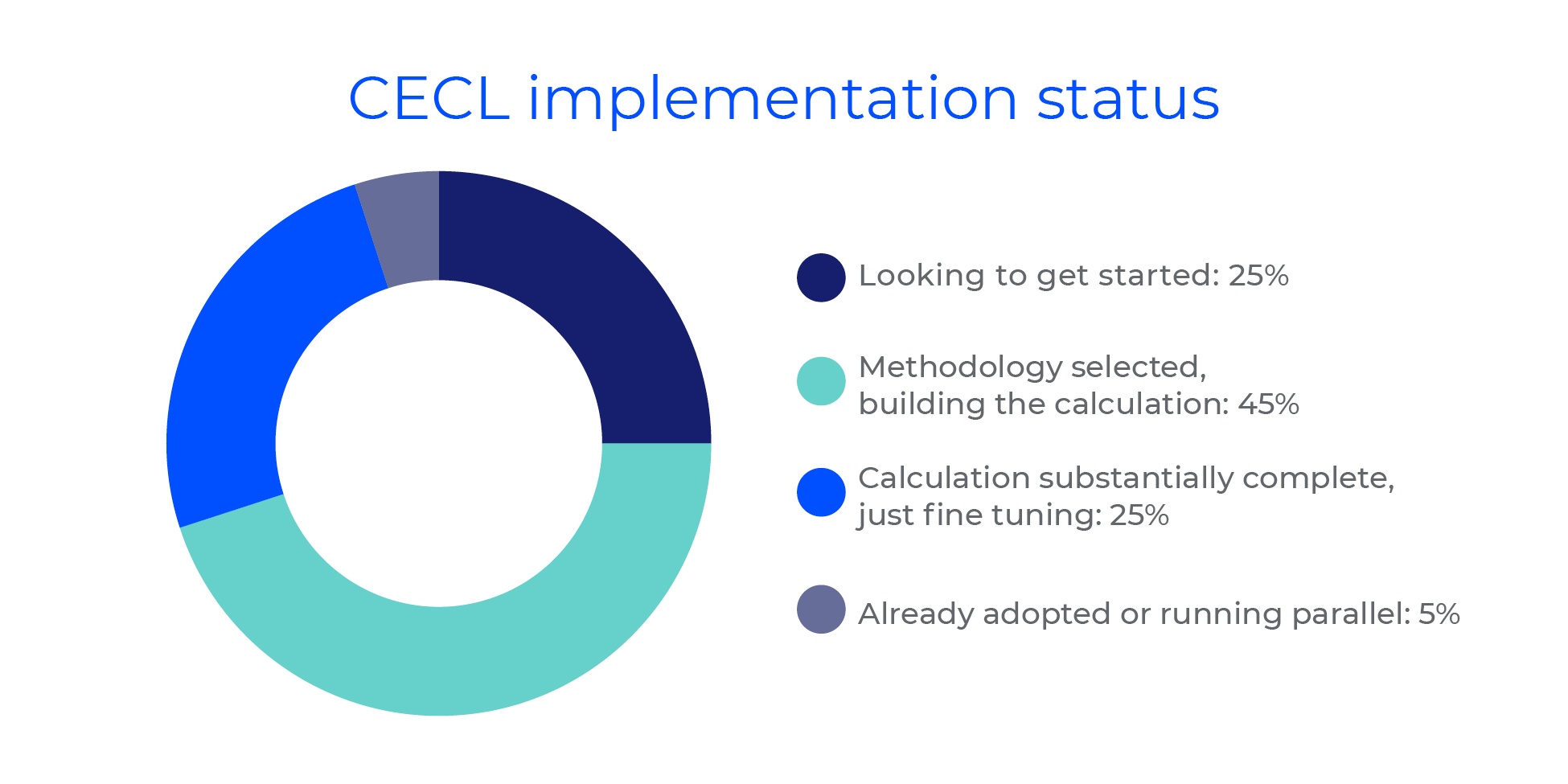

Question 1: Where are you at with CECL implementation?

These results suggest that many institutions still have substantial work to do to be ready to adopt CECL in 2023, with 70% of respondents still either looking to get started or building the calculation. The substantial challenges and rapid growth experienced by many financial institutions over the past 18 months seem to have set many institutions behind in their adoption timeline.

These results are likely impacting the expected methodology selection (see next question), with many institutions expecting to select methodologies that are less data intensive.

While it may require some additional effort in the short term, we strongly recommend institutions try to build their calculation as early as possible during 2022. This will allow the institution to run parallel calculations for multiple quarters in advance of adoption. Early adopters of CECL have found that substantial improvements have been made to the calculation based on insights learned while running parallel.

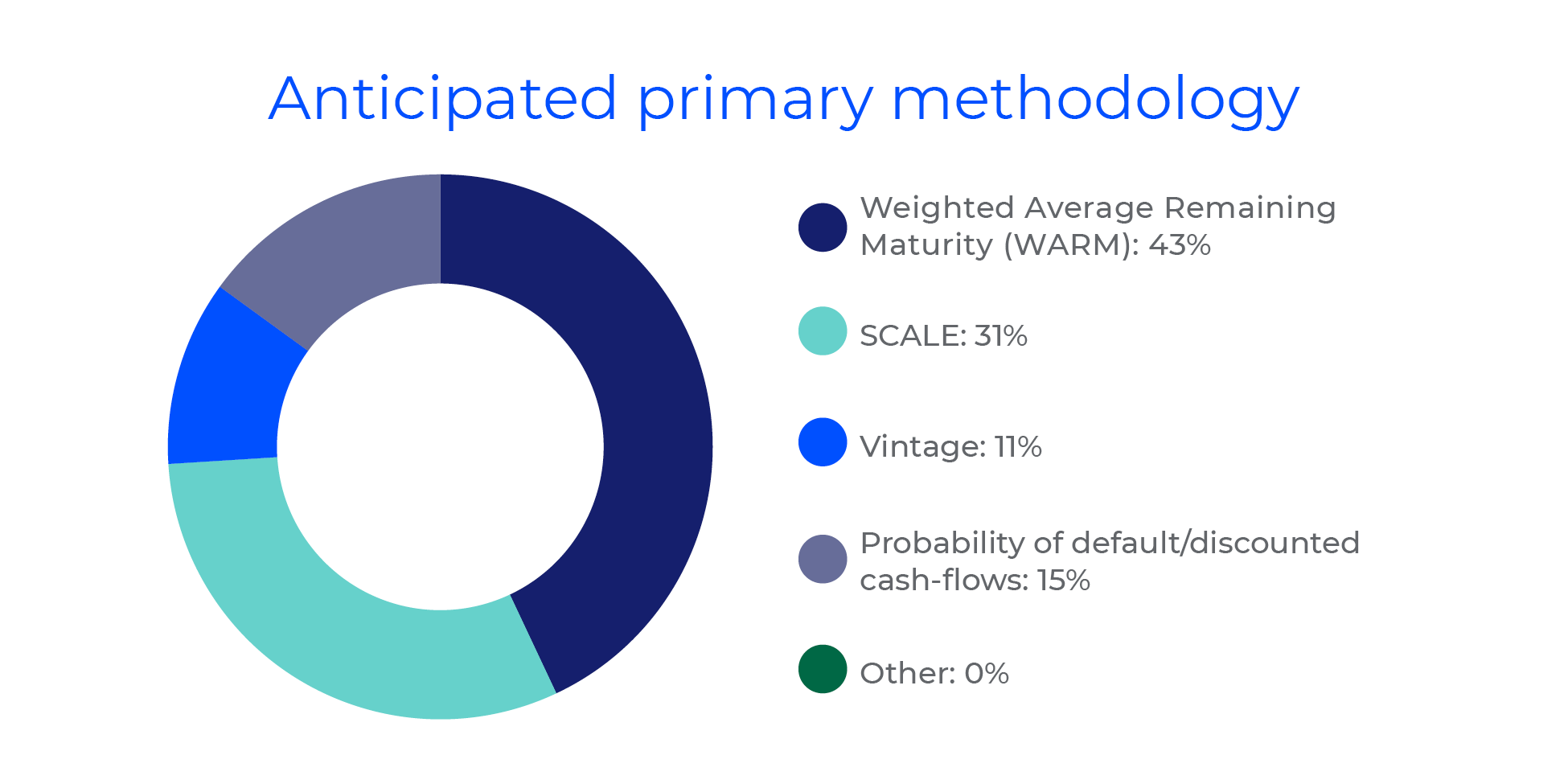

Question 2: What do you anticipate will be your primary CECL methodology?

The Weighted Average Remaining Maturity Methodology (WARM) received a plurality of the votes, followed by the SCALE method. Interestingly, both the WARM and SCALE methodologies were not introduced in the accounting standard issued by FASB, but instead were methodologies introduced subsequently by the industry.

These two methodologies have the benefit of generally requiring less historical data, which may simplify the process of developing and maintaining the calculation. As the CECL implementation deadline draws nearer, we anticipate institutions will continue to focus more on less complex approaches like WARM and SCALE.

The results of our poll are noticeably different from similar surveys that focused more on SEC respondents. Those polls have generally shown significantly higher usage for more complex methodologies, such as probability of default or discounted cash flows.

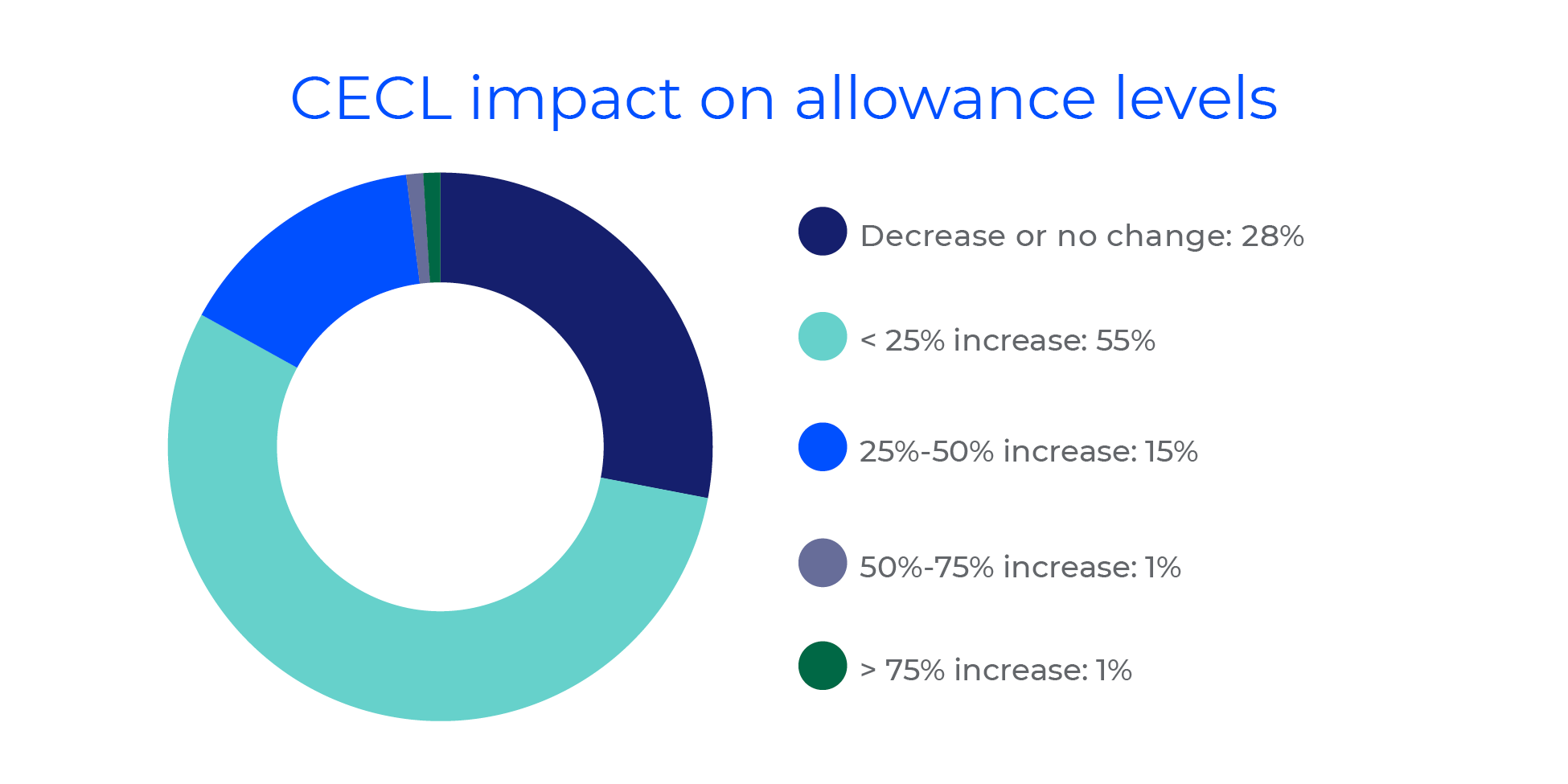

Question 3: What impact do you believe CECL will have on your allowance levels?

The poll results suggest that most institutions aren’t expecting CECL to have a significant impact on their allowance funding levels, with 28% of respondents suggesting their allowance will likely decrease or stay consistent, and an additional 55% estimating their allowance will increase by less than 25%.

On average, SEC companies that have already adopted CECL saw allowance levels increase more than our respondents are anticipating. (See this article for more: Measuring the impact of CECL adoption.)

The poll results may be impacted by an institution’s current approach to allowance funding. It is our experience that smaller, community-based institutions are more apt to fund their allowance at levels higher than calculated requirements compared with publicly traded banks. In addition, the respondent institutions in our poll generally have minimal levels of credit cards and portfolio long-term mortgages, which are loan types that have been more significantly impacted by CECL.

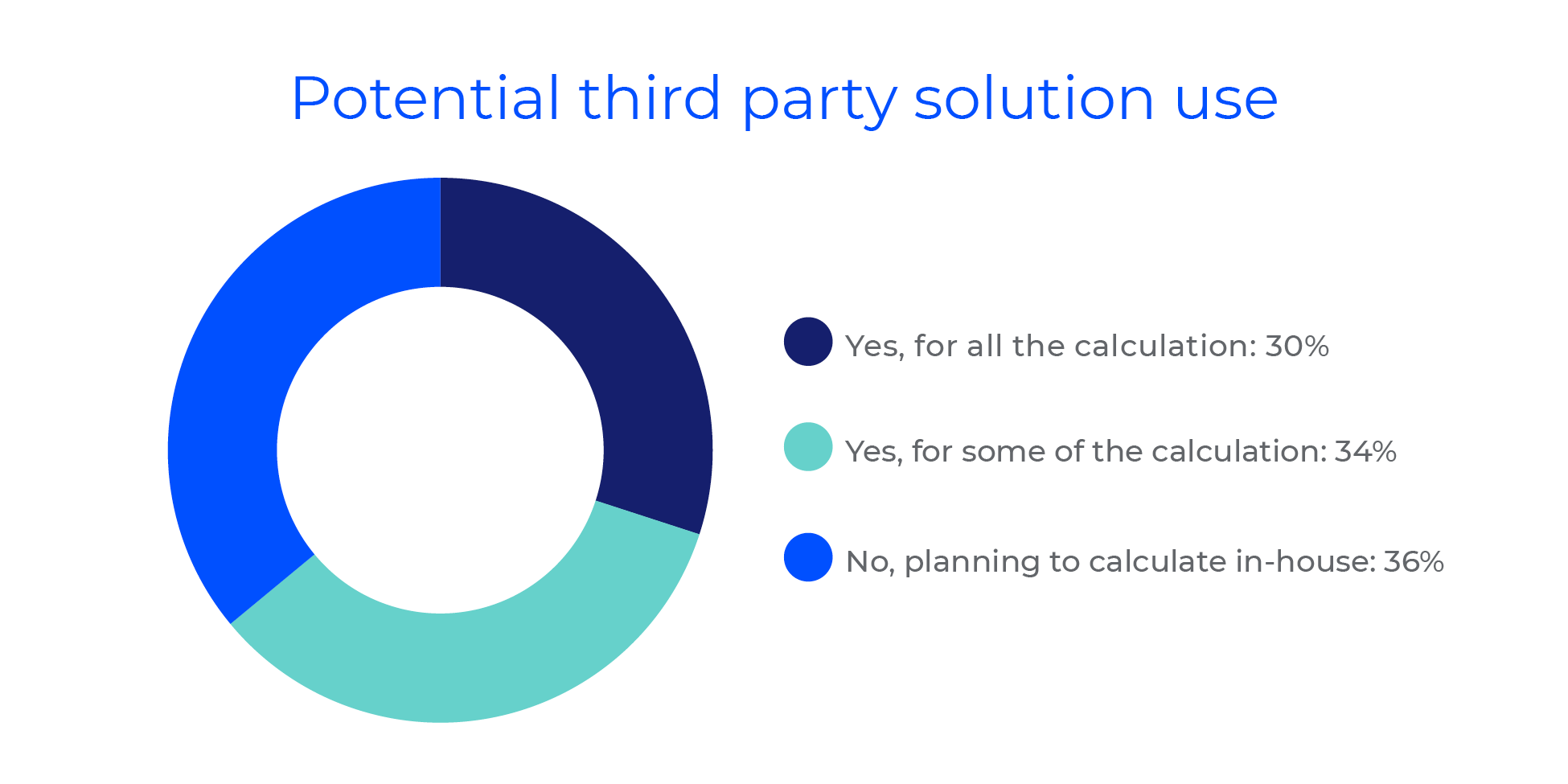

Question 4: Do you anticipate using a third-party solution for CECL?

A number of service providers have introduced CECL products designed to simplify the process of developing and maintaining a CECL calculation. Institutions will need to evaluate whether they would prefer to invest in an outside product or develop an internal approach for evaluating the allowance under CECL.

Sixty-four percent of our respondents are anticipating using a third-party solution for at least a portion of their CECL calculation. We anticipate that percentage will increase as the CECL adoption date draws nearer and less time is available for in-house development.

It is notable, however, that 36% of respondents are anticipating managing their CECL calculation fully in-house. Regulators have consistently suggested that a well-designed, spreadsheet-based calculation will be acceptable, and a significant number of institutions appear to prefer that approach.

Need help with your CECL implementation?

Wipfli offers a CECL calculation tool that’s powerful and easy to use.

Sign up to receive additional financial institutions and CECL information in your inbox, or continue reading on: