Succession Planning: A Critical Talent Retention Strategy

Succession planning and talent retention is a significant area of concern and focus for everyone from the board of directors to human resource leaders.

Today’s highly competitive labor market makes finding quality talent a challenge. As the qualified labor market continues to shrink and demographic shifts escalate, banks need to make the succession planning, development and retention of talent a key strategic priority.

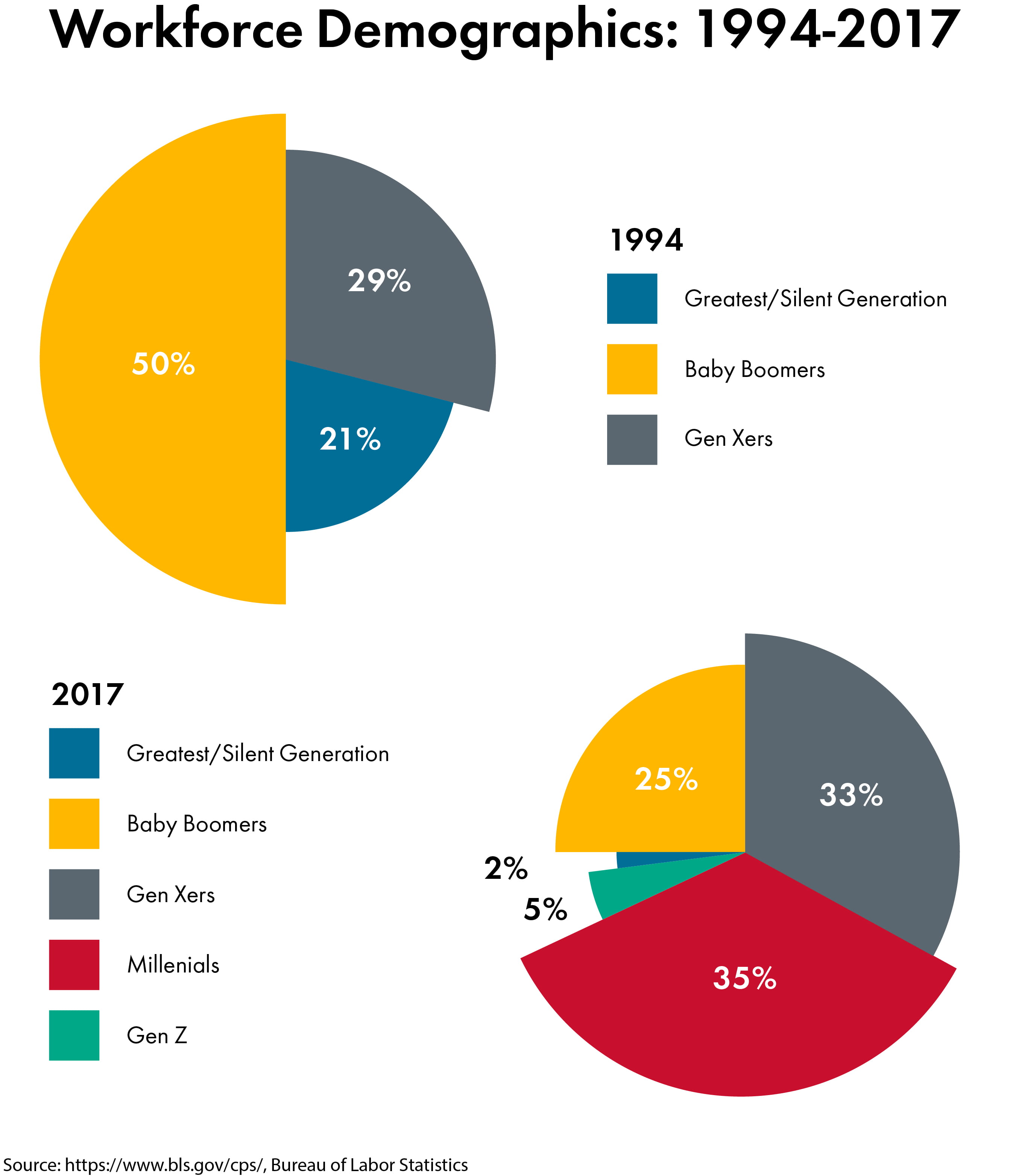

There is a tremendous amount of generational diversity in the workforce making it essential to establish an intentional, systematic strategy for the inherent differences and strengths of each generation.

Research shows that over 10,000 Baby Boomers are retiring each day. More than one third of all working Americans is a millennial, making them the largest generation in the workforce.

This generation is leapfrogging Xers and Boomers into positions of leadership and various other roles of responsibility. It’s clear that assessing talent and effectively managing individual development and succession is critical to ensure appropriate knowledge, skills, competencies, and experience for those assuming new and/or higher levels of responsibility.

Executive leadership and human resource professionals often appear to put off succession planning for more pressing priorities because the return on the investment is too far in the future.

Succession management is a core component of the human resources strategy. However, it is not exclusively owned by human resources, but rather, is the responsibility for everyone in a leadership position. It is incumbent upon leadership to invest in people to ensure a deep and continuous supply of talent.

The key leadership questions related to succession and talent include:

- Do we have the talent with the potential to move into various roles within the bank and into the highest levels of leadership?

- Are we focusing talent development on the right roles and the right individuals?

- Do we have a solid understanding of the skills and experiences needed for success in the roles?

- Have we identified our “least able to lose” talent? And do we have a plan to retain them?

- Are the vision and values of the bank consistent with the vision, values, and ambitions of the potential successor candidates?

- What should we be doing to prepare and develop talent today so that they are ready in the future?

A succession management program focuses on mission critical positions and mission critical talent.

There are several key components to consider:

- Clarifying future needs: Clarifying the skills, knowledge, experiences, behaviors and attributes needed for success in key roles is an important first step. This provides the foundation for identifying, assessing and developing future successors.

- Assessing talent: Engaging in a facilitated discussion around talent with multiple inputs and perspectives provides insight into the depth of the talent pool. A common tool used to for this discussion is a nine-box matrix, whichreflects the performance and potential of each employee. The assessment of employees guides the bank’s investment in development and can identify roadblocks to having robust talent pools.

- Identifying successor readiness: Knowing the readiness of successor candidates is critical for effective planning. Readiness charts can help identify employees’ strengths and development needs and track who is immediately ready to assume a role, who may be able to serve in an interim capacity, and those who may be ready over time for key/critical roles.

- Understanding employee career interests: Asking employees about their career goals and interests ensures that the bank’s investment in development is targeting people who have interest and passion in a potential opportunity. Succession planning processes should include discussions with employees to understand what future they aspire to within the bank.

- Developing talent: Developing talent is an ongoing process and is driven by a talent assessment that identifies potential gaps for each employee. Stretch assignments, special projects, coaching and mentoring are important techniques used to develop talent.

- Ongoing review: Ongoing review keeps a succession planning program alive, relevant and meaningful. Best practice suggests that talent assessments are reviewed with leaders every 9-15 months and again when there is a major leadership change or significant shifts in the banks business model. Plans should be adapted as business needs, strategic priorities, role definitions, staffing and goals change. No business is static nor is succession planning.

High-performing banks and those aspiring to be top of class understand that success is built upon the knowledge, skills, and abilities of its employees. Talent — the people — is a bank’s competitive advantage in the market.